#Hydra Chain’s staking system dynamically adjusts APR (Annual Percentage Rate) based on three key components: vesting duration, market sentiment (macro factor), and entry timing (RSI bonus). While current conditions offer conservative returns, they also create excellent potential for rare strategic positioning by long-term stakers. 🧠📈

The Current State of Hydra APR 📊 (Sep 2025)

- RSI Bonus: 1.7x (RSI currently ~4)

- Macro Factor: 0.25x (bearish market) 🐻

- Base APR: 5.0%

Hydra’s APR formula:

APR = (Base APR + Vesting Bonus) × Macro Factor × RSI Bonus

Under these conditions, the Unvested APR is:

(5.0% + 0) × 0.25 + 1.7 = 1.25%

And the 52 week vested APR is calculated like this:

(5.0% + 21.78%) × 0.25 + 1.7 = 11.38%

The vesting bonus above (21.78%) is calculated using the following formula:

Vesting bonus = (Weeks × 0.15)^1.5

With 52 weeks of vesting, the APR currently reaches a modest 11.38%. This may seem a little low, but it highlights Hydra’s defensive 🛡️ low-inflation strategy for bearish markets, while still being reasonably competitive compared to other assets. The data above is from the Hydra staking dashboard.

How Each Factor Affects APR 🧾

As mentioned above, Hydra’s APR formula is:

APR = (Base APR + Vesting Bonus) × Macro Factor × RSI Bonus

1. Vesting Bonus ⏳

- Grows APR exponentially according to the number of weeks vested.

- Maxes out at ~21.78% for a 52 week lock.

2. Macro Factor 📉

- This factor is recalculated continuously and is applied to all active staking positions.

- Adjusts with market trends using the SMA(115)/SMA(310) price ratio.

- SMA stands for Simple Moving Average — a commonly used metric that smooths out price data over time. Hydra uses the ratio between a shorter-term (115-day) and longer-term (310-day) SMA to gauge momentum and overall trend.

- Because SMAs reflect historical averages, changes in the macro factor lag behind real-time price movements.

- Currently ~0.64, placing us in the lowest tier: 0.25x multiplier.

3. RSI Bonus 📊

- This factor is recalculated continuously and is locked in at the moment you open the position.

- Based on the 14-day Relative Strength Index (RSI):

RSI < 35: Oversold ➡️ 1.15x bonus

RSI < 30: Fear ➡️ 1.25x bonus

RSI < 20: Extreme fear➡️ 1.7x bonus 🚨

- The RSI (Relative Strength Index) is a momentum indicator used in technical analysis to measure the speed and change of price movements. It helps assess whether an asset is overbought (bullish) or oversold (bearish).

- Current RSI ~4 = maximum 1.7x bonus!

On the chart above, we can see:

- SMA(115)/SMA(310) price ratio (blue line, currently 0.64).

- RSI (purple line, currently 3.84)

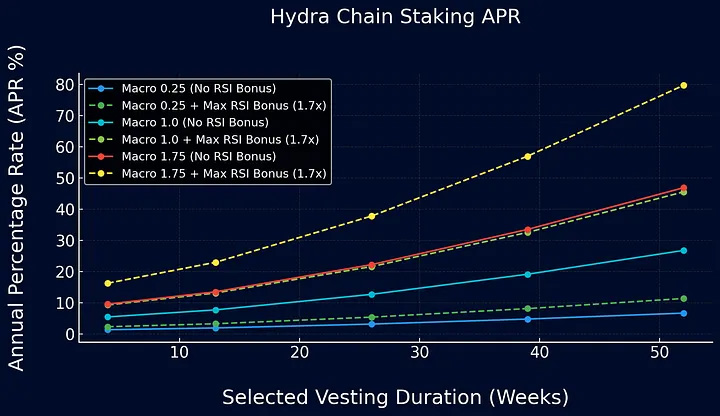

Simulation: APR vs Selected Vesting Duration 📈

The above graph visualizes APR outcomes across vesting durations under a few different macro and RSI scenarios. The maximum theoretical APR (~80%) occurs only when:

- Vesting = 52 weeks

- Macro Factor = 1.75 🚀

- RSI Bonus = 1.7x ⚡

This shows how stacking all incentives at the right time can dramatically increase yield potential 📈

Why Strategic Positioning Still Matters 🧠🔍

Despite the relatively low current APR, entering early or preparing to stake during opportune RSI windows can offer future advantages:

1. Start the Vesting Clock ⌛Time is a multiplier — the longer the duration you choose to lock your stake, the more of the vesting bonus you earn, scaling non-linearly up to 52 weeks. Starting earlier means earlier access to staking rewards.

2. Macro Factor is Dynamic 🔄Even if you enter at the current 0.25x, your APR will increase when market conditions improve during your vesting period.

3. RSI Bonus is Locked in 🔐Starting staking at lower RSI (< 30 or < 20) locks in a higher multiplier that stays fixed throughout your entire stake. Even RSI < 35 gives a meaningful boost (1.15x), with higher tiers available below 30 and 20. High RSI Bonuses are usually not available for long. The current maximum bonus of 1.7x represents a rare opportunity to potentially achieve the maximum APR of 80%, should the macro factor climb in the future.

Together, these allow for strategic upside without needing perfect market timing. 🎯

Final Thoughts 💬

Hydra’s APR system is built for long-term sustainability, not short-term hype. It dynamically adjusts staking rewards to reflect broader market sentiment — scaling inflation down in bearish periods to preserve price integrity, and ramping it up during bullish phases to reward commitment.

While current APR may seem low, users who time their entry wisely — choosing strong vesting durations and staking during low RSI — are well-positioned to benefit from upside when conditions shift.

Think ahead. Stake wisely! 🧭💎