You’ve learned what a liquidity pool is and how to make your first deposit. Now it’s time to explore a professional-level strategy designed to maximize your capital’s efficiency and supercharge your potential earnings: Concentrated Liquidity.

This feature, available on advanced DEXs like HydraDEX, is a game-changer for serious liquidity providers.

🚧 The Problem with “Dumb” Liquidity

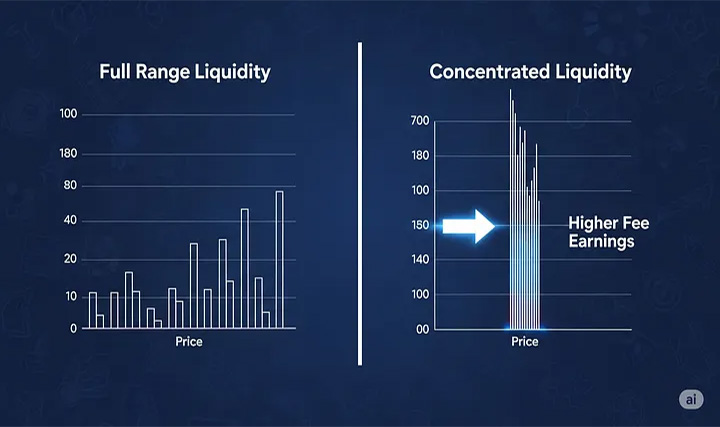

In a traditional liquidity pool, when you deposit your tokens, your liquidity is spread out across an enormous price range — from zero to infinity.

Think about it: if HYDRA is trading at $0.18, what are the chances of it dropping to $0.02 or skyrocketing to $5 in the next hour? Extremely low. Yet, a significant portion of your deposited capital is sitting there, reserved for these unlikely scenarios. This is inefficient. Most of your money isn’t actively working for you or earning fees.

🧠 The Solution: Make Your Capital Work Smarter

Concentrated liquidity solves this problem by allowing you to choose a specific price range in which your capital will be active.

Instead of providing liquidity from $0 to infinity, you could, for example, concentrate your entire position in a much tighter range where you expect the most trading to happen — say, between $0.17 and $0.20 for the HYDRA/USDC pair.

By doing this, you are effectively putting your money where the action is.

For the full details on how to achieve this, please see our in-depth guide.

💹 The Power of Capital Efficiency

The benefits of this targeted approach are immense.

Higher Fee Earnings: Because your capital is concentrated in a tight, active trading range, you earn a much larger share of the trading fees compared to someone with the same amount of money spread across the full range.

Increased Capital Efficiency: It allows you to earn the same amount of fees as a much larger “full range” position, but with significantly less capital. This frees up your other assets for different opportunities.

⚠️ The Inherent Trade-Off: Managing Your Range

This powerful strategy comes with one crucial trade-off. If the market price of the asset moves outside of your selected range, your position becomes inactive. It will stop earning fees until the price moves back within your chosen boundaries.

Furthermore, when your position goes out of range, your assets will be entirely converted into one of the two tokens in the pair. If the price drops below your minimum ($0.17 in our example), you’ll be holding 100% HYDRA. If it moves above your maximum ($0.20), you’ll be holding 100% USDC. This amplifies the risk of impermanent loss if you don’t manage your position actively.

⚙️ Why Hydra is the Perfect Venue for Active LPs (Liquidity Providers)

This is where the power of Hydra Chain becomes a key advantage. The need to actively manage concentrated liquidity positions — adjusting ranges as the market moves — can be expensive on slow, high-fee blockchains.

With Hydra’s sub-second transaction finality and extremely low network fees, LPs can adjust their positions quickly and affordably, ensuring their capital remains active and efficient. This turns concentrated liquidity from a high-stakes gamble into a manageable and powerful strategy.

🧭 Conclusion: The End of One Journey, The Start of Another

You have now journeyed from a DeFi novice to understanding the most advanced strategies used by professional liquidity providers. By mastering these concepts, you are no longer just a passive holder of crypto; you are an active participant in the decentralized economy, with the tools to put your assets to work.

Disclaimer: This content is for educational and entertainment purposes only. It does not constitute financial advice or an endorsement of any project. Always do your own research and assess risks before engaging with any platform.