Since its inception in 2009, the world’s first and largest cryptocurrency has consistently reached new all-time highs from each halving cycle, proving to be one of the best-performing assets in recent times. Serving as the bellwether for the entire crypto industry, activity on the bitcoin network has also grown significantly, with the arrival of more active miners and users on the network.

This report aims to not only cover Bitcoin’s price developments and user activity, but also how the asset and network have evolved well beyond its original use case, diving deep into the adoption of Bitcoin across ETFs, CEXes, and even nations, as well as the network’s latest innovations and updates.

We’ve summarized the key highlights, but be sure to dig into the full 17 slides below.

Top 6 Highlights of CoinGecko’s Bitcoin in 2025

-

Bitcoin Has Historically Climbed Through New Highs After Each Halving, but the Quantum of Increase Has Shrank

-

Bitcoin Outpaced Other Risk Assets in 2024 With a +119% Gain, Still Leads All Other Assets Except Gold in 2025

-

Number of Bitcoin Active Addresses Hit 944K in August 2025, Though Numbers Remain Affected By Price Volatility and Ecosystem Activity

-

US Spot Bitcoin ETFs Have Experienced $54.4B in Net Inflows and Accumulated Over 1.29M BTC, or ~6% of the Total Supply Since Approval in 2024

-

Bitcoin Mining Hashrate Crossed 1 Zettahash for the First Time, as Major Players Continue to Expand Their Infrastructure

-

Bitcoin Has Quickly Become a Treasury Asset for Publicly Listed Companies, With Over 1 Million BTC Accumulated,

1. Bitcoin Has Historically Climbed Through New Highs After Each Halving, but the Quantum of Increase Continues to Shrink

With each subsequent halving cycle, the supply of new Bitcoin entering circulation drops by half, leading to increased scarcity over time. Since the first halving in 2012, block rewards have dropped by 87.5%, from 25 BTC to 3.125 BTC.

In the same period, the price of Bitcoin rose by 9110x to $109,000 on September 1, 2025. Notably, Bitcoin has consistently reached new all-time highs throughout each cycle, usually occurring post-halving. However, this trend was bucked in March 2024, when BTC reached a new ATH of $73,400 before the fourth halving.

The degree of post-halving price gains have compressed over time since the second halving, with peak cycle returns falling from 29x in 2017 to 6.7x in 2021, and just +93.1% so far in 2025. Trading volume has also risen monumentally from ~$20 million in 2013 to ~$30 billion in 2025.

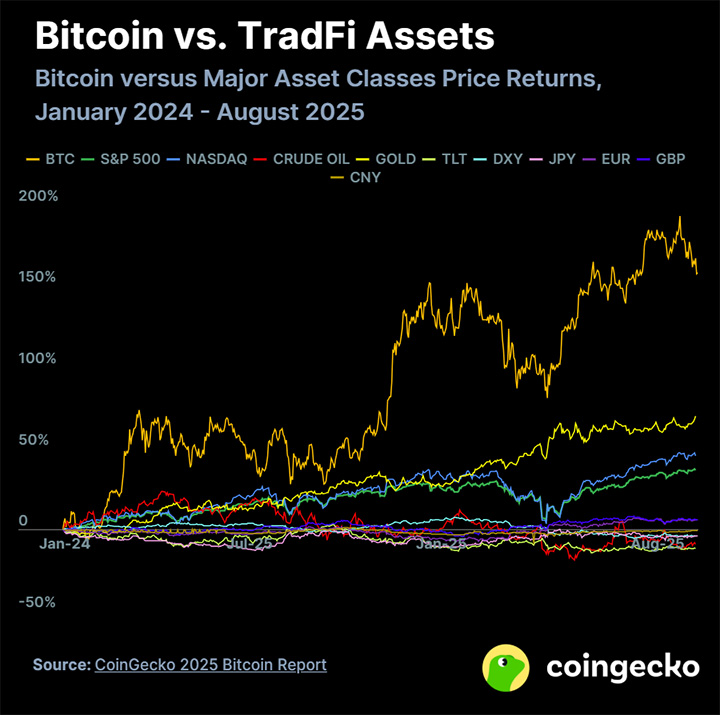

2. Bitcoin Outpaced Other Risk Assets in 2024 With a +119% Gain, Still Leads All Other Assets Except Gold in 2025

Bitcoin outperformed the annualized return of traditional assets in 2024, posting a +119% price growth for the year, ahead of the +24.0% and +30.8% returns by the S&P 500 and the Nasdaq, respectively. However, both indices are catching up with Bitcoin’s +16.3% increase in 2025, as BTC’s correlation with the S&P 500 continues its uptrend, rising from 0.75 in 2024 to 0.86 in 2025.

Meanwhile, Gold has been the second best performer over the past two years, extending gains by +31.7% year-to-date, amidst rising concerns of economic uncertainty and Trump’s tariffs coming into effect. Despite its moniker as ‘digital gold,’ BTC’s correlation with gold has weakened from 0.64 in 2024 to 0.53 as of August 2025.

On the other hand, the outlook for the US dollar has turned bleak in 2025, with a -10.4% plunge. Trump’s economic policies have weakened the dollar since his inauguration at the start of the year.

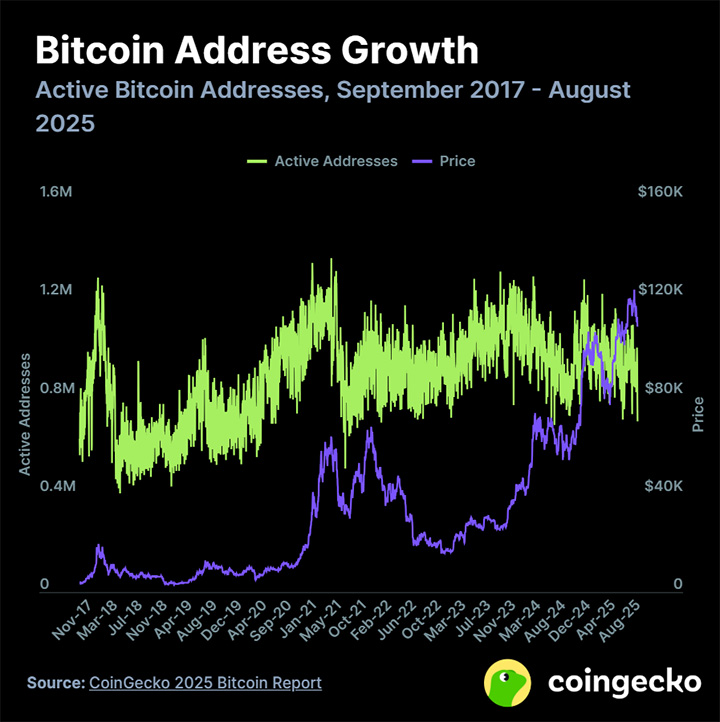

3. Number of Bitcoin Active Addresses Hit 944K in August 2025, Though Numbers Remain Affected By Price Volatility and Ecosystem Activity

Despite suffering a 68% drop in active users during the crypto bear market of 2018, the average daily users on Bitcoin has recovered steadily by 41.7% from 666,000 in 2018 to 944,000 as of August 2025.

Uptrends in Bitcoin network activity tend to precede major price movements. The network recorded its all-time high of 1.36 million active users in April 2021 as BTC broke past the $64,000 level and remained elevated at ~1.0 million daily users before BTC’s -35% price plunge in May.

However, that dynamic has somewhat shifted since 2023 with the introduction of Bitcoin Ordinals and BRC-20 in early 2023. As these projects gained more hype and traction, active Bitcoin users rose from an average of 900,000 in 2023 January to 1.10 million daily users in 2023 May and has continued to ebb and flow with Ordinals trading activity.

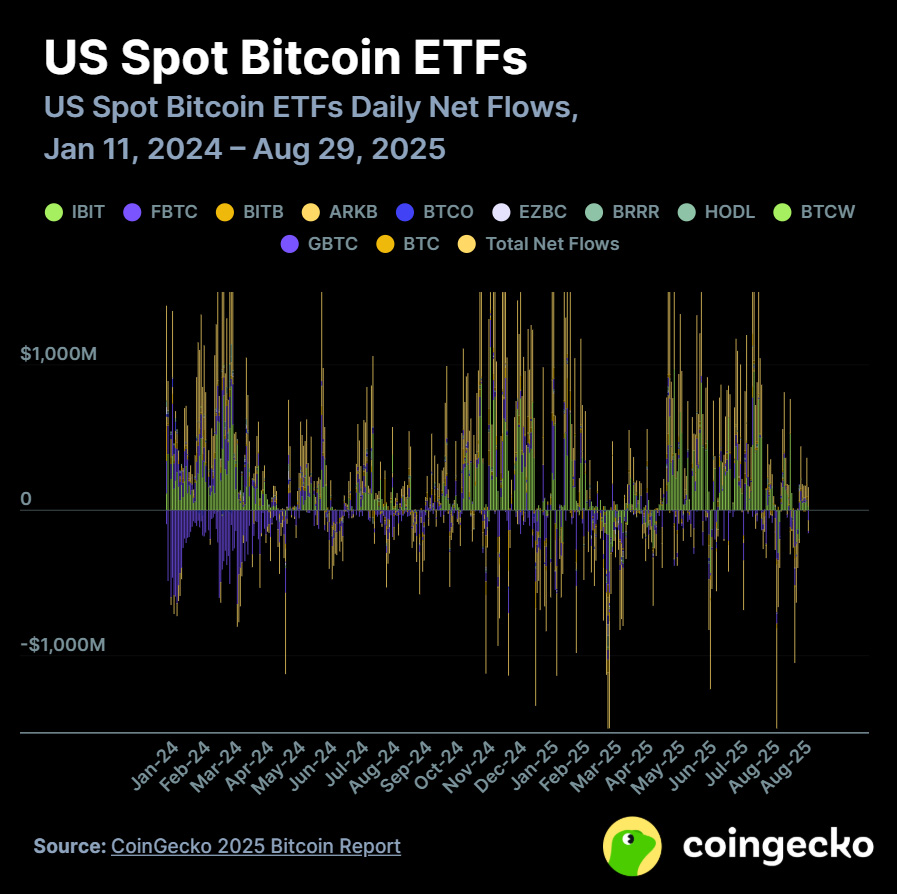

4. US Spot Bitcoin ETFs Have Accumulated Over 1.29M BTC, or Approximately 6% of the Total Supply Since Approval in 2024

Since the launch of spot Bitcoin ETFs in the US, 10 out of 11 products have received ~$54.4B in cumulative net inflows, growing their respective AUMs by up to +748,000%, and accumulating over 1.29 million BTC. The only exception is Grayscale’s converted GBTC ETF, which has seen net outflows of ~$9.5 billion since it began trading.

As the largest spot Bitcoin ETF in terms of AUM, BlackRock’s IBIT rapidly established its dominance by growing its market share from 0.04% in January 2024 to 52.6% as of end-August 2025. The product’s share of trading volume has also risen from 22.1% to 75.4% in the same period.

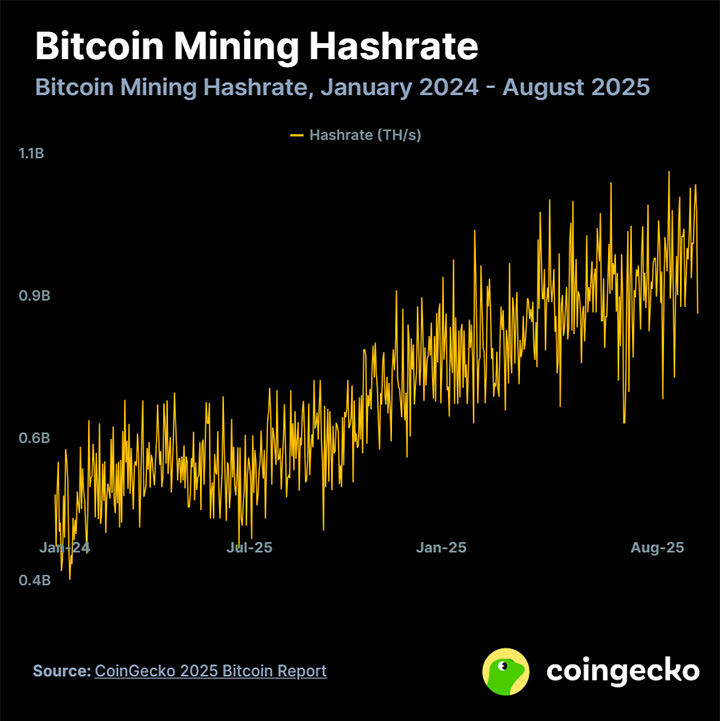

5. Bitcoin Mining Hashrate Crossed 1 Zettahash for the First Time, as Major Players Continue to Expand Their Infrastructure

Since Bitcoin’s inception, the mining hashrate, or total computational power provided by miners to secure the network, has steadily climbed as more entities and institutions participate. Since 2024, the hashrate has climbed by 53.2% from 555M Th/s at the start of last year to 851M Th/s on August 31, 2025.

The network surpassed the 1 Zettahash (1 billion TH/s) milestone in early April and achieved a new ATH of 1.085 Zettahashes on August 4.

Under the Trump administration, the Bitcoin mining landscape has continued to proliferate in the US. Chinese-based mining hardware manufacturers such as Bitmain, Canaan, and MicroBT have relocated production to the US due to added pressure from tariffs. Meanwhile, existing US players such as HIVE, Hut 8, Marathon, and CleanSpark are focusing more on alternative energy sources for new facilities. Eric Trump, the son of Donald Trump, recently co-founded American Bitcoin Corp, a mining firm that debuted on the Nasdaq.

6. Bitcoin Has Quickly Become a Treasury Asset for Publicly Listed Companies, With Over 1 Million BTC Accumulate

Bitcoin is increasingly being adopted as a treasury asset by publicly listed companies, a trend popularized by Michael Saylor’s Strategy (previously known as MicroStrategy). As of August 31, 1,001,953 BTC was held by 102 listed firms, nearly 5% of the total BTC supply. Strategy leads with 632,457 BTC, representing 63.2% of all corporate-held Bitcoin, and added another 4,048 BTC on September 2.

New entrants are also building sizable positions. Twenty One, backed by Tether, Bitfinex, Cantor Fitzgerald, and SoftBank, has acquired 43,514 BTC since its launch in May, making it the third largest holder. Healthcare firm KindlyMD entered the space through a merger with Nakamoto BTC Holdings, bringing in 5,764 BTC, and announced plans to raise $5 billion to expand its treasury. Outside the U.S., companies like MetaPlanet in Japan and Treasury BV in Europe are also establishing themselves as major Bitcoin treasuries, with Treasury BV raising $147 million to purchase over 1,000 BTC.

This article was kindly provided for publication on Hydragon.blog website by CoinGecko.