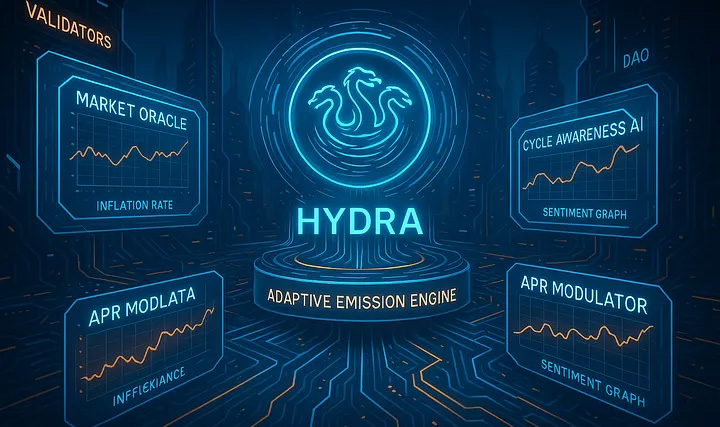

Hydra Chain introduces blockchain’s first data-driven economic model, using embedded oracles to dynamically adjust network emissions based on market conditions. This system replaces traditional fixed emission schedules with an intelligent algorithm that recognizes and adapts to market cycles.

At its core, Hydra’s nodes act as price oracles, monitoring market conditions through a thoroughly back tested SMA crossover system {115/310}. This data feeds into the Macro Factor — a multiplier that automatically adjusts network emissions to optimize economic stability and security.

Unlike static chains that maintain fixed inflation regardless of market conditions, Hydra mirrors natural adaptation principles. During bear markets, the system automatically reduces emissions to preserve value, protecting its core community and trying to outperform other static digital assets which have higher exposure. When market conditions improve, the system strategically increases emissions to fuel growth and adoption.

This approach emerged from extensive testing of over 10,000 parameter combinations, effectively positioning Hydra to compete with Bitcoin and other digital assets across market cycles. The system’s decisions are governed by transparent smart contracts integrated into the consensus mechanism, ensuring complete decentralization of these economic adjustments.

For users and investors, this means participating in the first truly market-aware blockchain economy. Hydra’s algorithmic halving mechanism doesn’t just respond to time-based schedules — it actively adapts to protect and enhance value based on real-time market conditions, creating a more resilient and competitive digital asset.