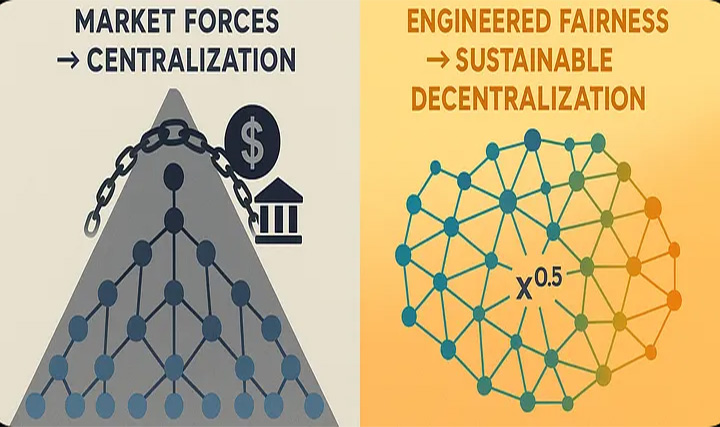

In the first two parts of this series (Part 1 | Part 2), we journeyed from the philosophical foundations of decentralization to the specific mechanics embedded within the Ethereum and Hydra protocols. We established that Ethereum relies on open market forces to shape its network, while Hydra opts for a deterministic approach, engineering fairness directly into its core logic.

Now, in this concluding article, we explore the ultimate consequences of these divergent paths. What do these architectural decisions mean for the long-term health, security, and integrity of each network? By projecting these designs into the future, we can understand their real-world impact and reveal why deliberately engineering decentralization is not just a feature, but a necessity for a sustainable blockchain ecosystem.

⚖️ The Inevitable Outcome of Market-Driven Models

Ethereum’s model, which trusts market dynamics to uphold decentralization, carries an inherent and growing risk: centralization. In any open market, economies of scale prevail. Larger, more capitalized players can offer more competitive services, absorb costs more effectively, and attract the lion’s share of capital. We see this playing out with the rise of liquid staking giants like Lido, which, along with a few major exchanges, now control a significant majority of all staked ETH.

This concentration of power creates systemic risk. It lowers the cost of a coordinated attack, introduces potential points of censorship, and slowly erodes the very “trustless” nature that gives blockchain its value. The high barrier to entry — requiring 32 ETH to run a solo validator — further entrenches the dominance of these large pools, making true grassroots participation a challenge for the average user. Over time, a network governed by market dynamics risks mirroring the centralized financial systems it was designed to replace.

🛡️ Hydra’s Blueprint for Sustainable Decentralization

In stark contrast, Hydra’s architecture is a direct response to these centralization vectors. It doesn’t hope for fairness; it enforces it mathematically. The cornerstone of this is the Exponentiating Staking Formula, which adjusts validator voting weight by a power of 0.5.

This is not a minor tweak; it is a fundamental rebalancing of power. The formula ensures that a validator’s influence does not grow linearly with their stake. A pool with 100 times the stake does not get 100 times the power — it gets only 10 times the power. This elegantly engineered mechanism directly counters the “rich get richer” effect, creating a permanent incentive for stake to be distributed across a wider and more diverse set of validators. It ensures that the network’s security is a collective responsibility, not one dominated by a few powerful entities.

🔮 Two Futures: The Choice Before Us

The divergence between these two philosophies paints a picture of two very different futures.

One future sees blockchains that, despite their innovative technology, gradually succumb to the centralizing forces of unregulated capital. Their security and neutrality become dependent on the goodwill of a handful of large corporations, reintroducing the single points of failure that the technology was meant to eliminate.

The other future, championed by Hydra, is one of systemic resilience. It is a future where the network’s decentralization is not left to chance but is a guaranteed, enduring property. By embedding fairness into its consensus, Hydra creates a perpetually level playing field that protects against capture, enhances censorship resistance, and fosters a truly distributed community of stakeholders. This is a system designed not just to function, but to last.

✅ Conclusion: Decentralization by Design

Across this three-part series, we have moved from philosophy to mechanics to consequences. The ultimate lesson is that genuine, long-term decentralization is not an accidental byproduct of market activity. It is a deliberate architectural choice.

Hydra Chain’s innovative model demonstrates a profound understanding of this principle. By choosing to hard-code fairness and mathematically limit the centralizing influence of capital, Hydra offers more than just another blockchain platform. It provides a compelling and robust blueprint for a truly decentralized future, ensuring that power remains where it belongs: with the many, not the few.